The AI invoice assistance built for South African Accountants

The AI invoice assistance built for South African Accountants

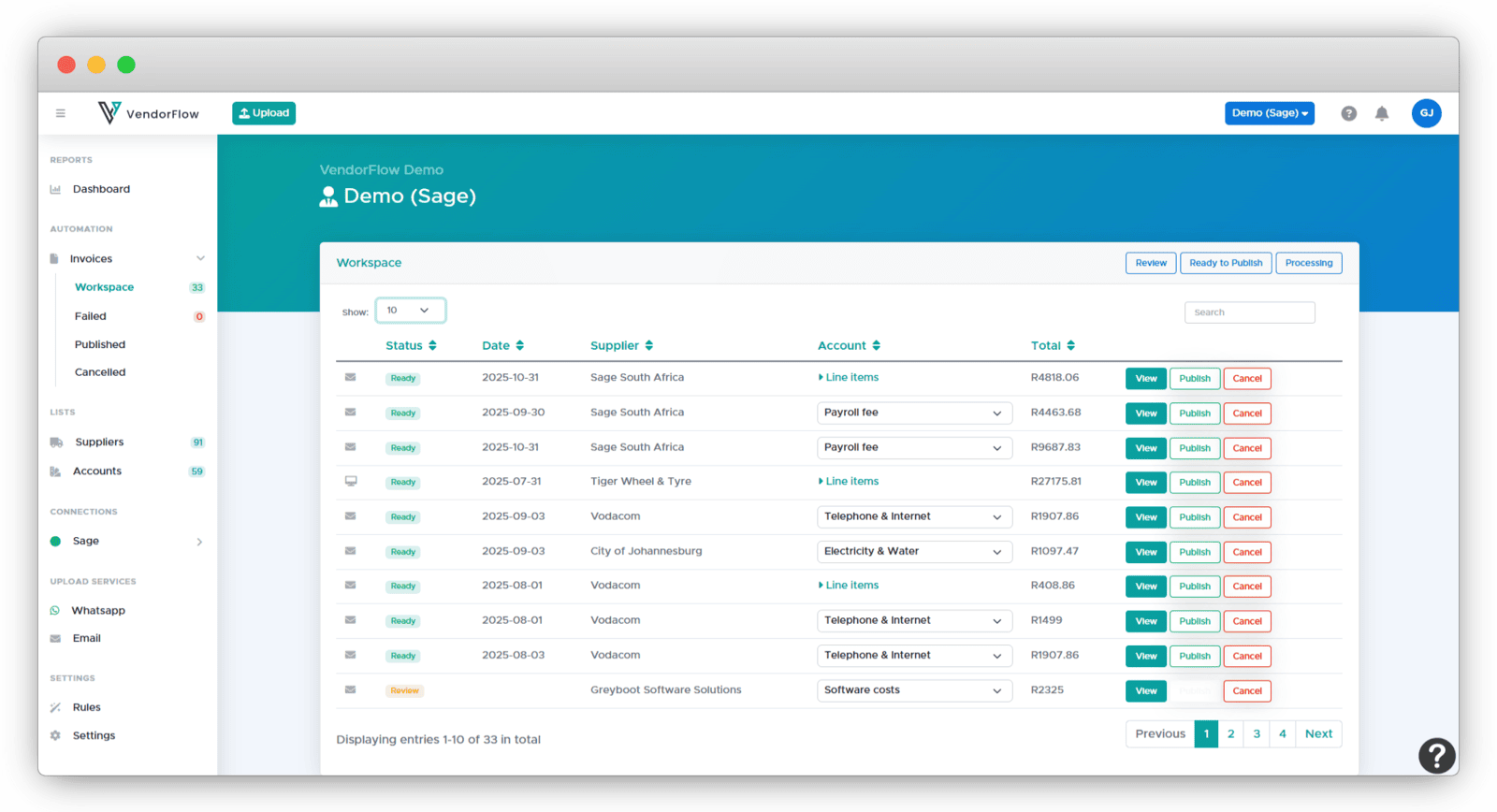

VendorFlow helps South African accountants and bookkeepers eliminate manual invoice processing without losing control.

We automate invoice capture, supplier matching, VAT classification, and posting — using a combination of accountant-defined rules and AI — so you spend less time capturing and fixing, and more time reviewing, advising, and growing your practice.

VendorFlow helps South African accountants and bookkeepers eliminate manual invoice processing without losing control.

We automate invoice capture, supplier matching, VAT classification, and posting — using a combination of accountant-defined rules and AI — so you spend less time capturing and fixing, and more time reviewing, advising, and growing your practice.

Built for the way South African firms actually work

South African invoices are inconsistent.

VAT treatment isn’t always obvious.

Clients send documents late — often by WhatsApp.

VendorFlow is designed for this reality.

Invoices can be sent via WhatsApp, email, or upload. From there, VendorFlow extracts, validates, applies rules, classifies, and prepares invoices for posting — with accountant-level logic you can trust.

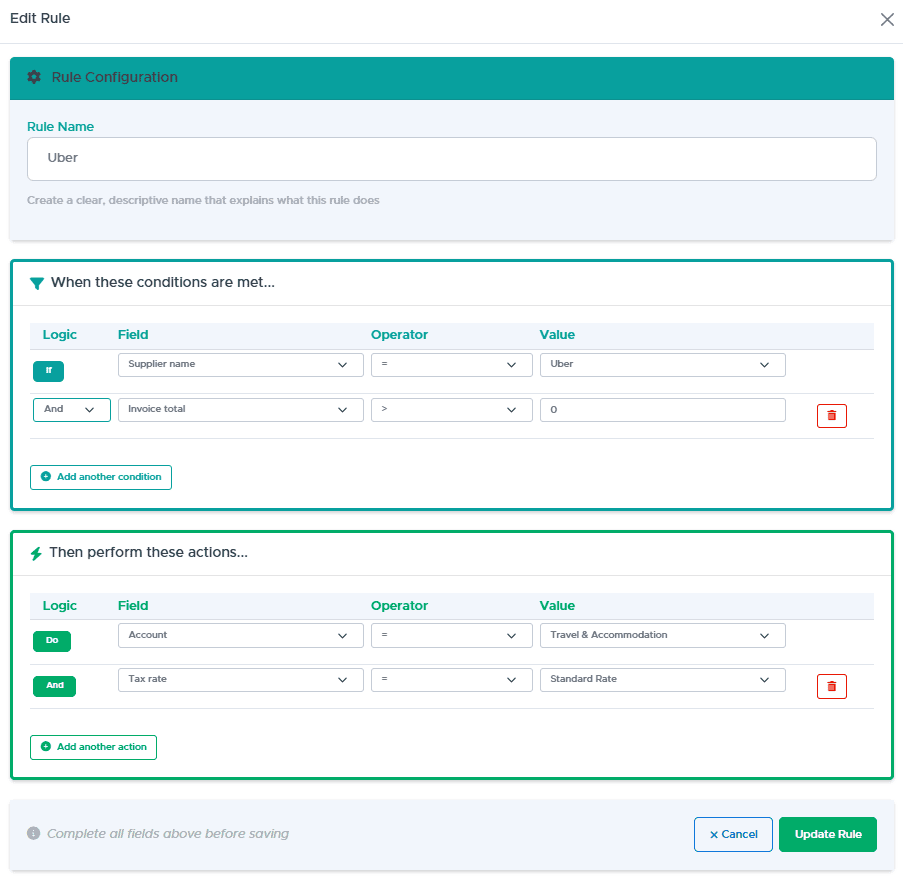

AI where it helps. Rules where it matters.

Not every invoice needs “intelligence”.

Recurring suppliers should behave predictably.

Random invoices should be reviewed carefully.

VendorFlow combines rules and AI so that:

predictable invoices stay predictable

exceptions are clearly flagged

nothing slips through silently

This allows firms to automate confidently without compromising audit discipline.

What VendorFlow Automates

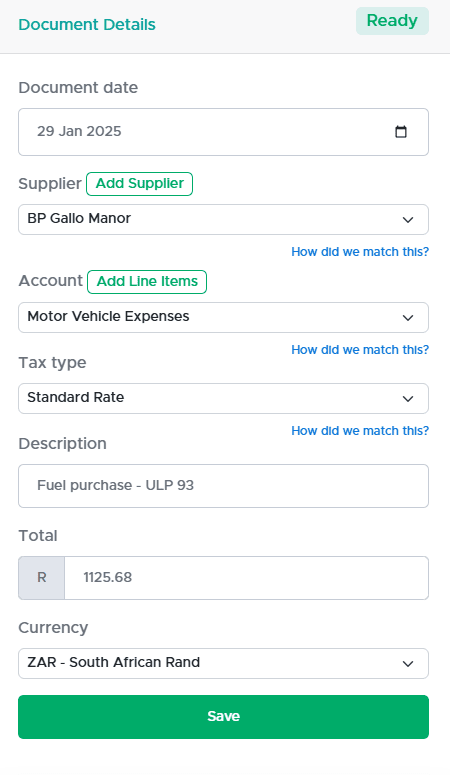

Invoice Capture That Understands SA Suppliers

VendorFlow reads supplier invoices and extracts:

Supplier name and VAT number

Invoice number and date

VAT, zero-rated and exempt amounts

Totals and line items

Rules Based Supplier Processing

For recurring suppliers, VendorFlow allows you to define rules per supplier, such as:

Which account the invoice must post to

Expected VAT treatment

Value or frequency expectations

Once set, these rules are applied consistently, month after month. Routine invoices flow through cleanly, and your team only spends time on the invoices that actually require judgement.

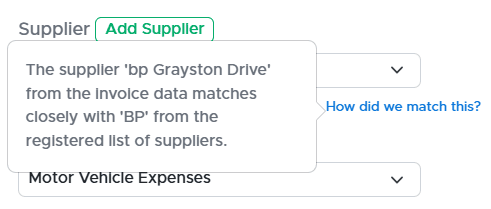

Intelligent Supplier Matching

VendorFlow matches invoices to existing suppliers automatically, helping you:

- Avoid duplicate supplier creation

- Maintain clean supplier master files

- Improve audit trails

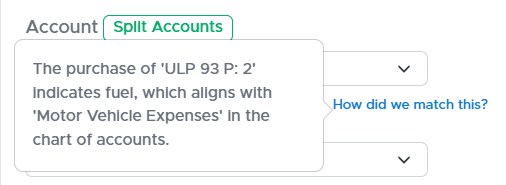

Context Aware Account Mapping

- Supplier history

- Prior postings

- Invoice wording and structure

This reduces mistakes and rework at review stage, especially on one off or unusual invoices.

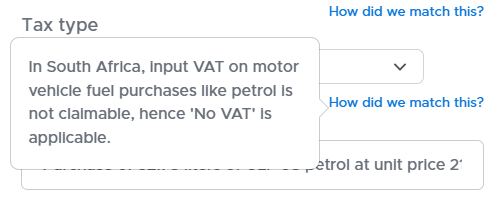

VAT Classification Designed for SA Accounting

VAT is applied by analysing both:

- The invoice content

- The account it’s posted to

This ensures more consistent VAT treatment across clients and periods.

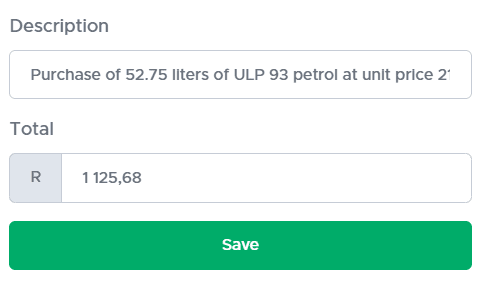

Proper Invoice Descriptions

VendorFlow creates clear, meaningful invoice descriptions directly from invoice content, improving:

- Financial statement quality

- Audit readiness

- Reviewer confidence

Why South African Accountants Choose VendorFlow

Why South African Accountants Choose VendorFlow

Save hours every week on invoice capture

Lock down recurring suppliers with rules

Reduce VAT errors caused by manual entry

Built-in controls that flag duplicates and inconsistencies

Cleaner ledgers with consistent allocations and descriptions

Scales across multiple clients and add unlimited staff

Lets juniors capture less and reviewers review more

Seamless Integration with Accounting Software

Seamless Integration with Accounting Software

Seamlessly integrate with Xero, Sage, and other platforms—VendorFlow automatically posts verified invoices directly into your system

Built in controls accountants can rely on

Invoices don’t silently duplicate, bypass controls, or overwrite data, even when clients submit via WhatsApp.

It includes audit-level checks that run automatically:

How It Works

How It Works

01

Collect Invoices

Collect Invoices

Send supplier invoices via WhatsApp, email, or direct upload

02

Rules + AI Processing

Rules + AI Processing

VendorFlow applies supplier rules first, then uses AI to classify and validate exceptions.

03

Seamless Publishing

Reviewed invoices are posted directly into your accounting system.

What Local Firms Are Saying

“What we like most about VendorFlow is the level of control it gives us. Recurring suppliers are locked down with rules, duplicates are caught automatically, and nothing posts without being reviewed, unless we want it to. It feels like the system is working with our processes, not forcing us to change them.”

Tashary Solutions

“VendorFlow has been a game changer for us. With our previous software, publishing invoices into the accounting system could take hours, which just doesn’t work when you receive large volumes at month end. VendorFlow is almost instantaneous. Combined with the rules engine, all our recurring invoices flow straight through, and we only need to review the exceptions. It’s made month end significantly easier.”

TPAS

Finance team, Church organisation

“VendorFlow is far more affordable than the software we were using before, and it’s delivering better results. The system is intuitive, easy for our team to use, and our clients love the WhatsApp upload option. It’s simplified invoice capture for everyone involved.”

Accounting Firm, Centurion

Upcoming Features

Featured Articles

How Invoice Automation with VendorFlow Can Transform Your Business

How Invoice Automation with VendorFlow Can Transform Your Business

Discover how VendorFlow's invoice automation features can simplify your invoice management process. Learn how automating data entry, approval workflows, and accounting integration can save time, reduce errors, and scale effortlessly for businesses and accountants alike.

Read more

How AI Can Solve VAT Allocation Errors for Accountants

VAT allocation is one of the most time consuming and error prone tasks in bookkeeping. Whether it’s missing VAT classifications, incorrect zero-rating applications, or handling mixed VAT invoices, these errors cost businesses money and create compliance risks.

For many accountants, manually reviewing VAT allocations is a tedious and repetitive process. But what if AI could handle it for you?

Read more